estate tax exemption 2022 build back better

The Build Back Better Act HR. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan.

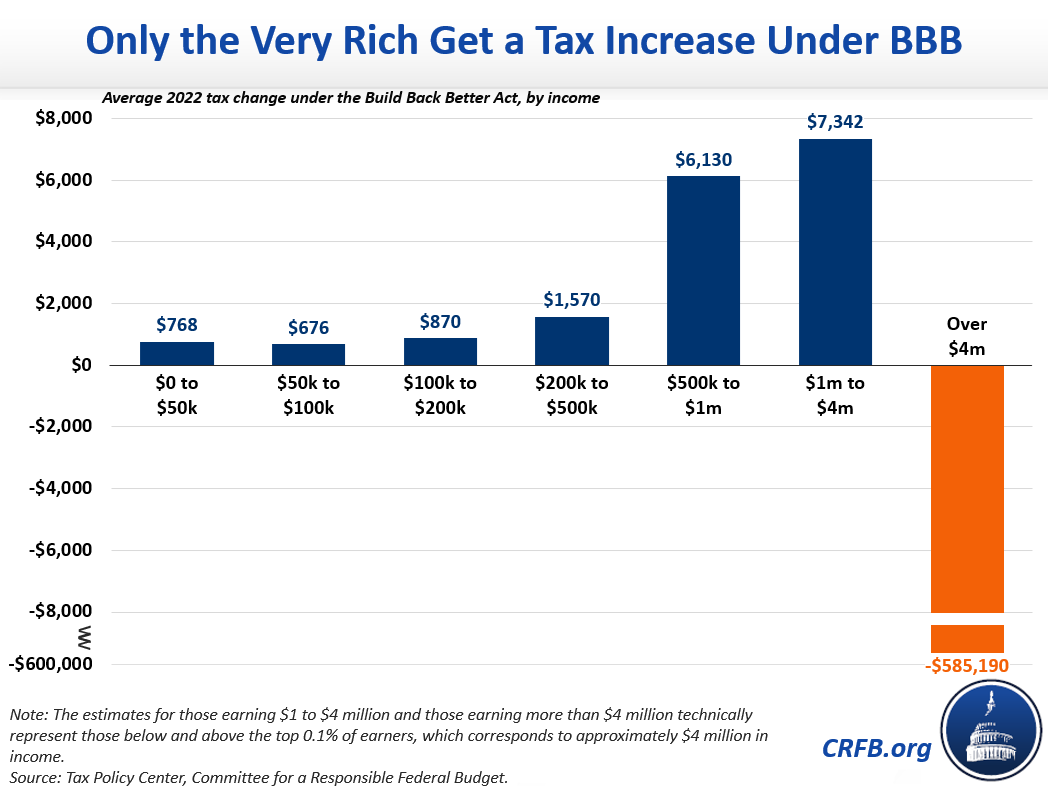

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers.

. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The package proposed reducing the current 117 million estategift tax exemption by 50 percent on january 1 2022 eliminating the use of valuation discounts for non-operating. The BBBA proposal seeks to reduce these.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. 2022 Annual Adjustments for Tax Provisions. The exclusion amount is for 2022 is 1206.

5376 contains no modifications to the estate and gift tax exclusion amount or the basis step up rules. Fortunately all of the above failed when 2022 arrived. Gift and Estate Taxes Proposed Under the Build Back Better Act.

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. There is still a step-up in basis for inherited property and assets. In short the proposed Build Back Better Act BBBA does the following.

Estate Tax Exemption 2022 Build Back Better. In 2022 the gift and estate tax exemption increased to 1206 million 2412 million for a married couple allowing families and estate planners to maximize lifetime gifts in. 28 2021 President Joe Biden announced a framework for changes to the US.

While many may breathe a sigh of relief. For 2022 and after reducing the current exemption by half for 2022-2025. The Joint Committee on Taxation JCT estimates this provision to raise 543 billion for FY2022- FY2031.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million. Lowering the gift and estate tax exemptions seems a lock.

The proposal seeks to accelerate that. Effective January 1 2022 the BBBA reduces the gift estate and GST tax exemptions from 11700000 per person. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

Elimination of the bonus estate tax. The exemption will increase. The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples.

Some of these proposed measures were written into the Build Back Better Act the Act draft published in September 2021. The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. The prior version of the Build Back Better bill included an acceleration of this reduction of the exemptions to January 1 2022.

The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Gift and Estate Taxes Proposed Under the Build Back Better Act.

Lowering the gift and estate tax exemptions seems a lock. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. The current estate and gift tax exemption of 2022 is 1206000000 or 2412000000 for a couple.

Ad Get free estate planning strategies. A reduction in the federal estate tax exemption amount which is currently 11700000. This was anticipated to drop to 5 million adjusted for inflation as of January 1.

Federal transfer tax developments Exemption amounts and rates. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. Lowering the gift and estate tax exemptions seems a lock.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The Build Back Better bill thats been bouncing around in Congress included a provision that would accelerate the sunset provision so that the exemption would drop to the. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on january 1 2026.

For 2022 the inflation-adjusted federal estate gift and GST tax exemption amounts are 1206 million for an individual up. Estate Taxes One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. There is another increase in the.

The BBBA proposal seeks to reduce these. Dont leave your 500K legacy to the government. The annual inflation adjustment for.

The revised bill does not include this.

Estate Planner S Guide To The Latest Version Of Build Back Better Wealth Management

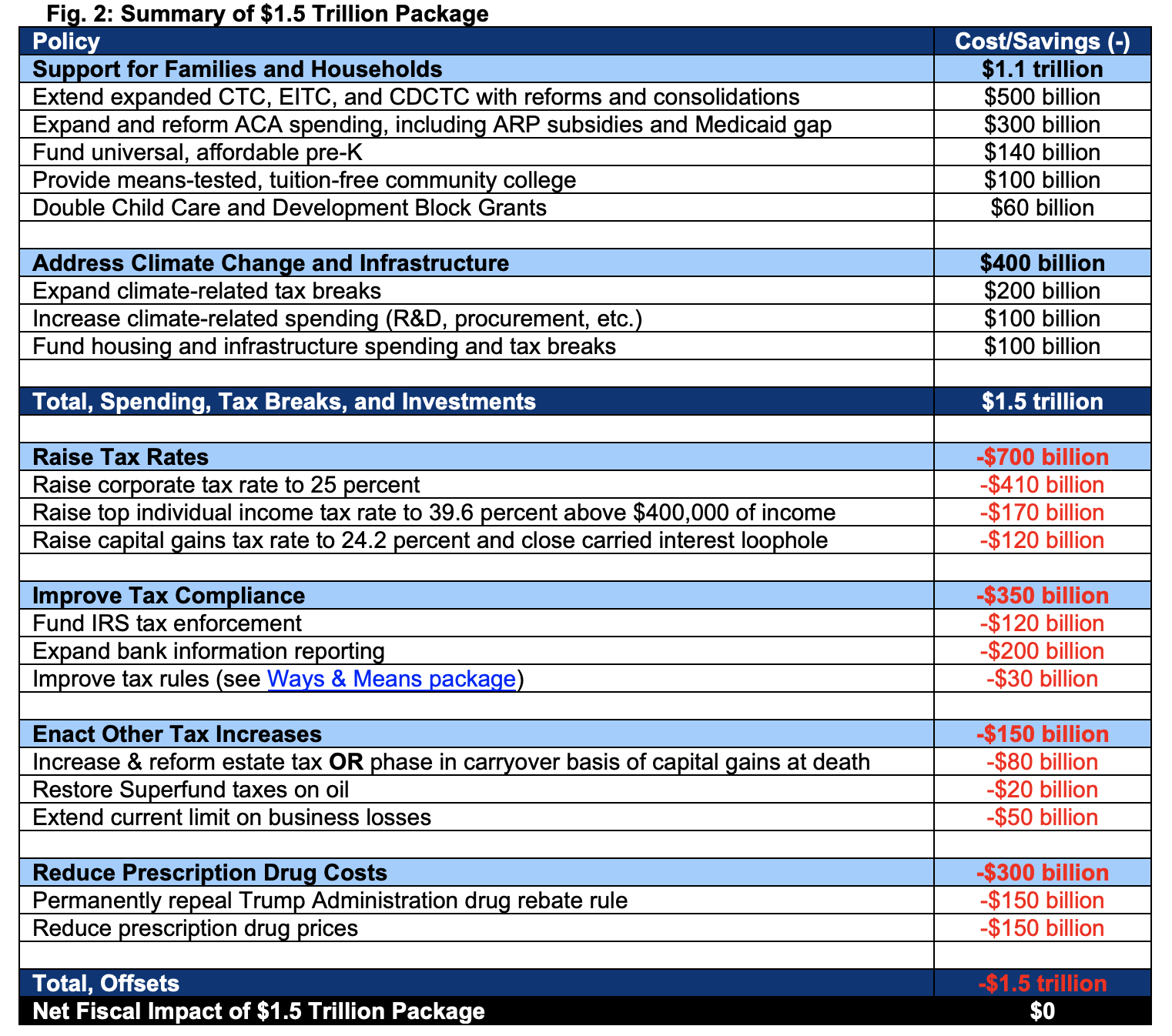

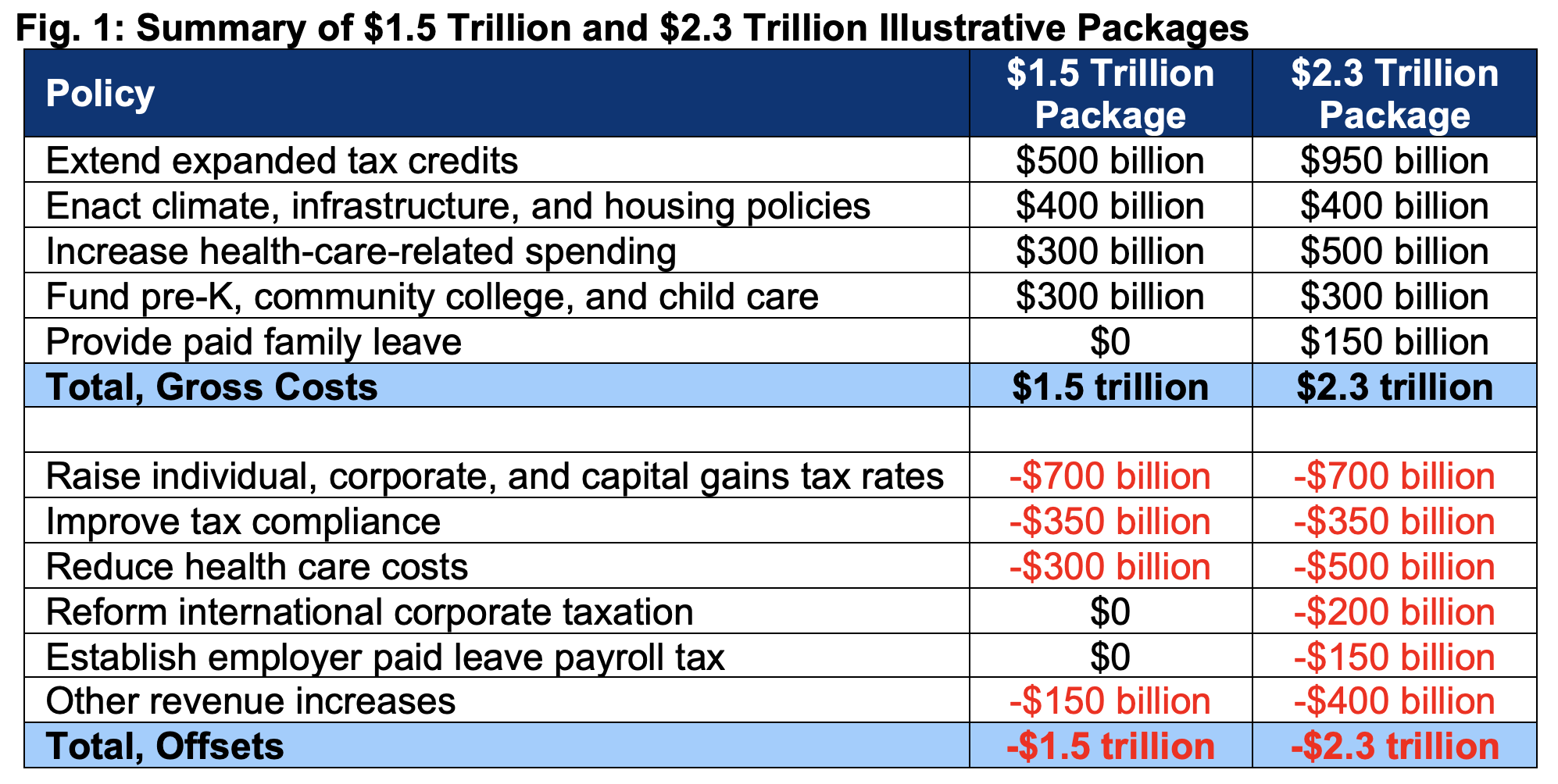

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Estate Planner S Guide To The Latest Version Of Build Back Better Wealth Management

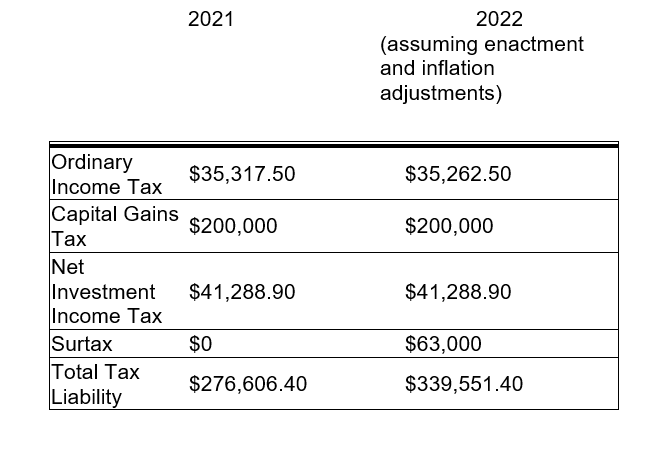

Tax Implications Of The Build Back Better Act Hunton Andrews Kurth Llp

2022 Updates To Estate And Gift Taxes Burner Law Group

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

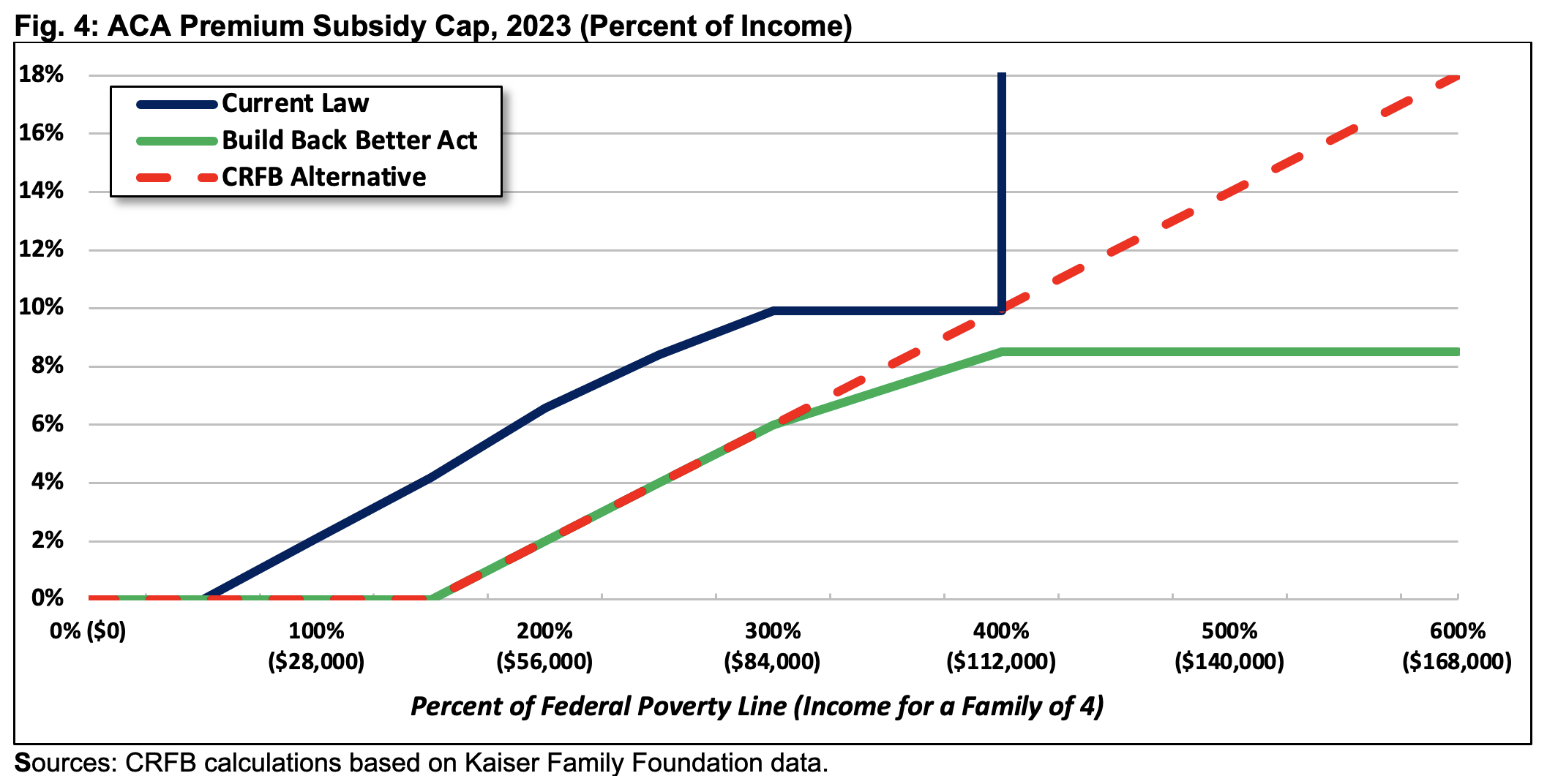

With A Smaller Build Back Better Here S What Aid Americans May Expect

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Tax Proposals Under The Build Back Better Act Version 2 0

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Dems Just Snuck A Tax Cut For The Rich Into Build Back Better Bill

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Proposed Build Back Better Act Contains Key Tax Provisions Our Insights Plante Moran

The Build Back Better Act The Senate Bill True Partners Consulting

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget