how to declare mileage on taxes

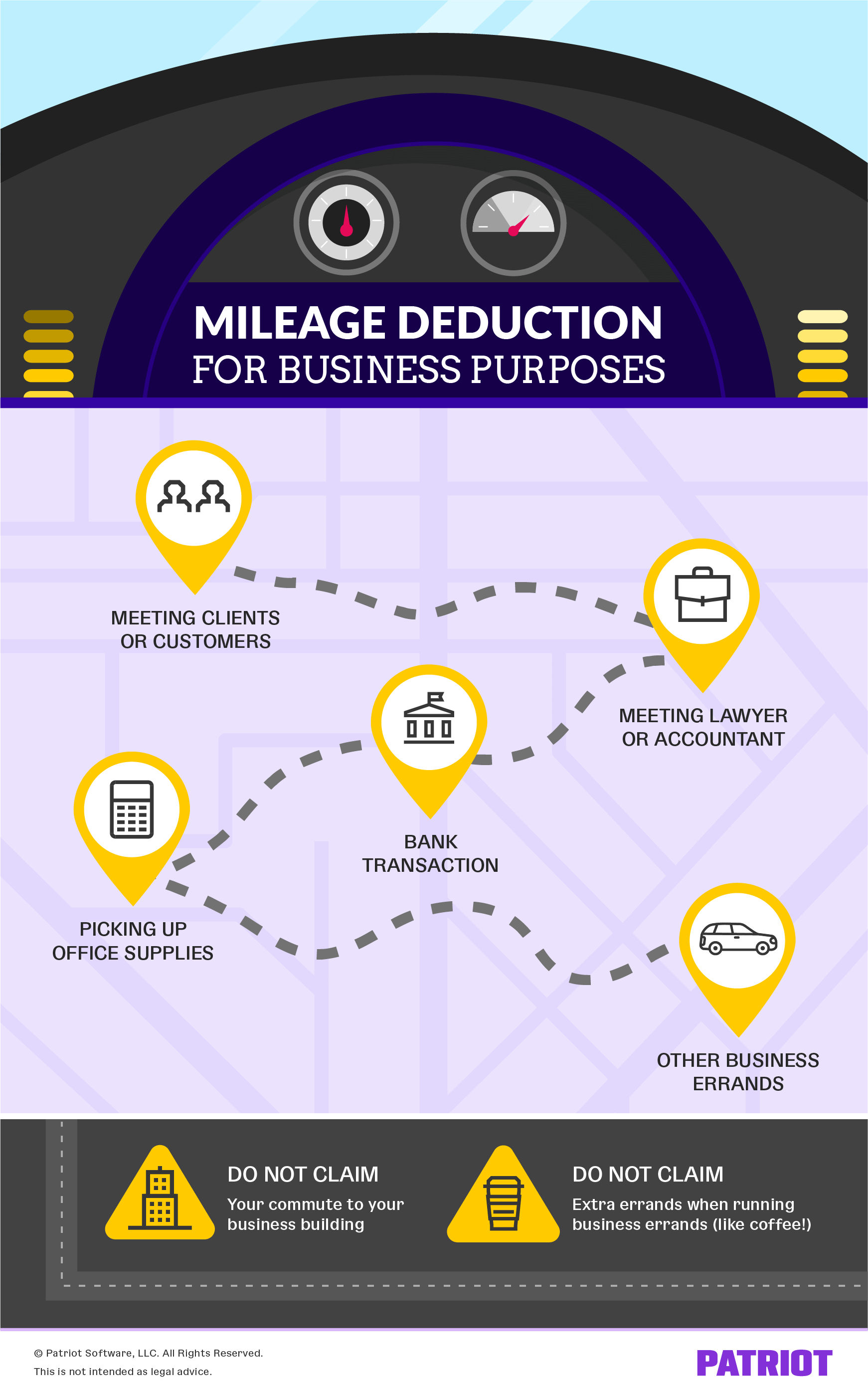

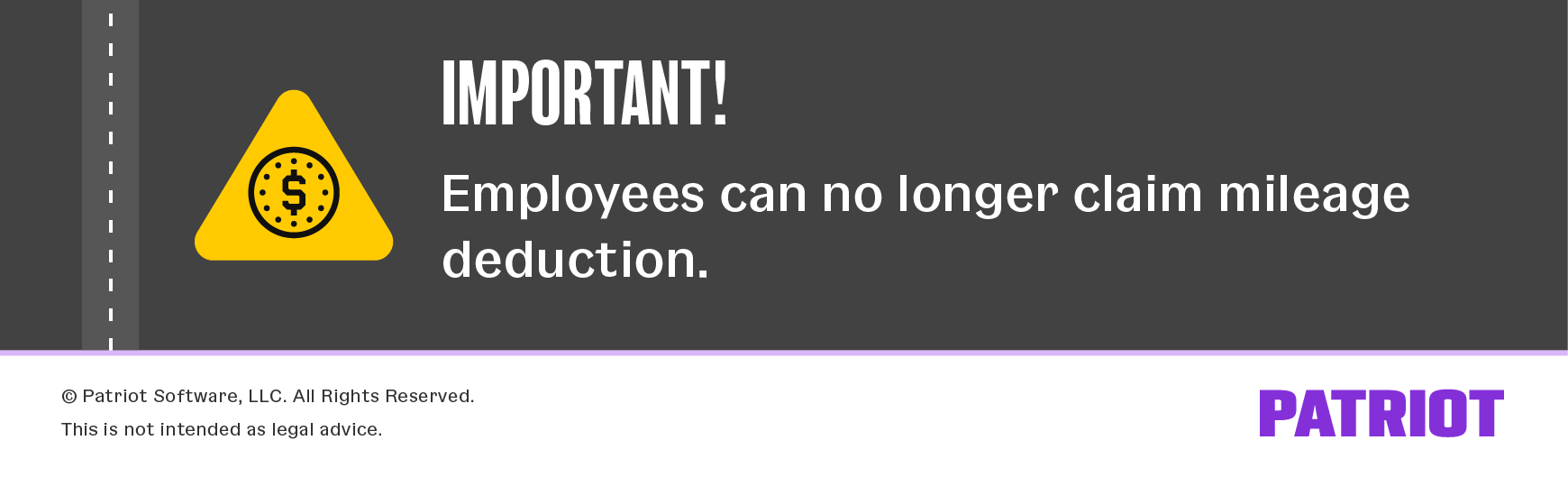

Business expenses for employees are generally non-deductible as of the Tax Cuts and Jobs Act of 2017 TCJA. Discover out what the 2022 IRS mileage fee is and what the IRSs guidelines are for taking this deduction.

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

You would figure your standard mileage rate deduction on IRS Form 2106 and report this amount on Schedule A of IRS Form 1040.

. Discover out what the 2022 IRS mileage fee is and what the IRSs guidelines are for taking this deduction. Enter your mileage expense by completing form 2106 employee business expenses. See What Credits and Deductions Apply to You.

Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year including mileage depreciation of your car and other costs. If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. 22 hours agoThe cemetery which gets a tax exemption takes up only 5700 square feet of the more than 500 acre golf club property.

Have Confidence Knowing You Did Your Taxes Right w A Final Review From Real Tax Experts. Taking the standard mileage deduction is. Miles driven for medical or work-related moving.

The best way to track your business miles is to write down your mileage at the beginning of the day and the end of the day. To use our calculator just input the type of vehicle and the business miles youve travelled in it for work. Every feature included for everyone.

If you use the actual expense method to claim gasoline on your taxes you cant also claim mileage. 535 cents per business mile 17 cents per mile for medical miles moving miles When completing your tax returns youll list the total amount of miles driven on form 2106 line 12. How to deduct mileage for taxes for the self employed.

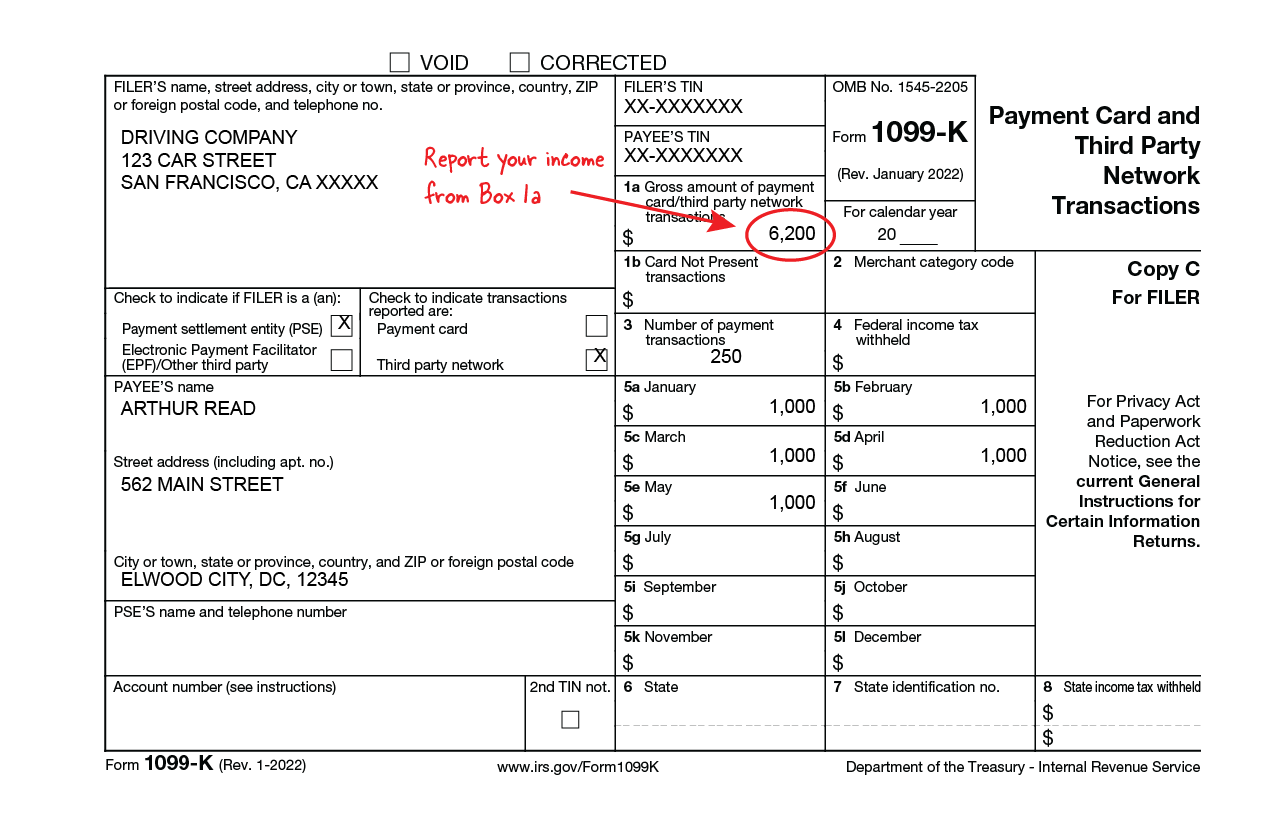

Taking the usual mileage deduction while you use your automotive for enterprise can yield massive financial savings in your taxes. Ad Enter Your Tax Information. You must pay tax on income you earn from gig work.

Ad Connect With A TurboTax Live Expert To Help You File Your Taxes Or Do Them For You. Back To Main Menu Close. Ad The Leading Online Publisher of National and State-specific Legal Documents.

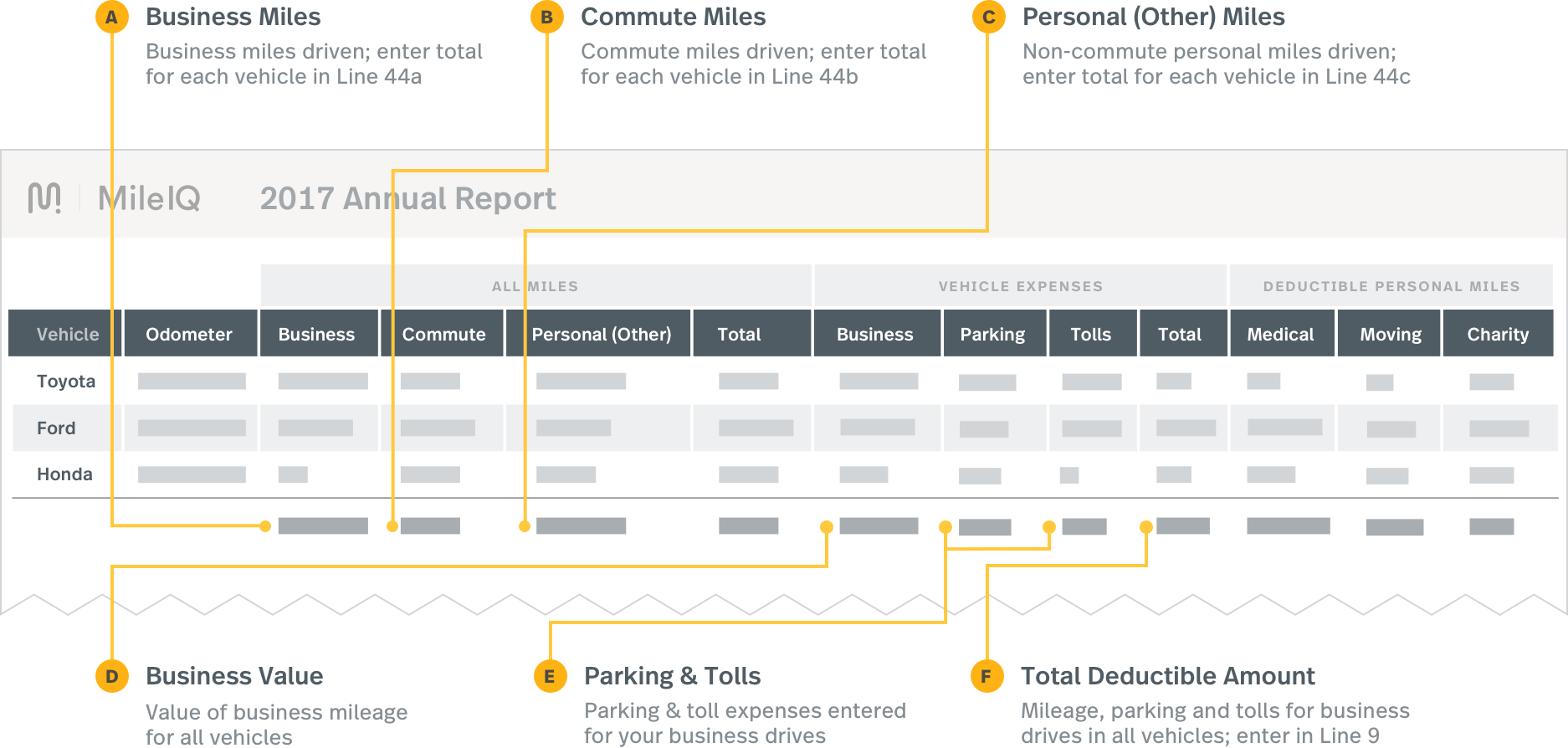

You need to keep track of your total number of miles that you drove during the year and the total number of miles you drove for business purposes. You would figure your standard mileage rate deduction on IRS Form 2106 and report this amount on Schedule A of IRS Form 1040. MileIQ makes gathering your total mileage stress-free too thanks to CVS and PDF reporting.

Rates per business mile. If you do gig work as an independent contractor you. If youre self-employed or an independent contractor however you can deduct mileage used solely for business purposes as a business-related expense.

Uber makes it easy to track your online miles. You can calculate your mileage tax deduction for 2021 by multiplying your total business miles by the standard deduction rate of 56 cents. E-File your tax return directly to the IRS.

Youll have all the documentation you need including start and end times classification and purpose distance monetary value of mileage. Enter your mileage expense by completing Form 2106 Employee Business Expenses. Taking the usual mileage deduction once you use your automotive for enterprise can yield massive financial savings in your taxes.

Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p. If you do gig work as an employee your employer should withhold tax from your paycheck. Dont worry if you use multiple vehicles.

Cars and vans after 10000 miles. For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by 1000 50000 times two percent. The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022.

Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. For those who use a automotive in your small business you could possibly be entitled to. 585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for 2021 and.

Business miles annual mileage business use. If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. When you use a automotive in your corporation you would be entitled to some substantial tax.

The detail of your expenses will be shown on either Form 2106 or 2106-EZ which is used to report employee business expenses. Prepare federal and state income taxes online. The standard mileage rate is easy to calculate.

There are two ways to calculate mileage reimbursement. 14 cents per mile. For the 2021 tax year the rates are.

Your beginning vehicle mileage. 18 cents per mile. The business portion is calculated the same way as mileage above.

How much does the IRS pay for mileage. Miles driven for charitable purposes. You must file a tax return if you have net earnings from self-employment of 400 or more from gig work even if its a side job part-time or temporary.

The mileage tax deduction is. The basis is multiplied by our business-use percentage to determine the depreciable basis of the vehicle for tax purposes.

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

What Business Mileage Is Tax Deductible

Mileage Tax Deduction Claim Or Take The Standard Deduction

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Irs Announces Standard Mileage Rates For 2022

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

25 Printable Irs Mileage Tracking Templates Gofar

Self Employed Mileage Deduction Guide Triplog

What Are The Mileage Deduction Rules H R Block

Mileage Vs Actual Expenses Which Method Is Best For Me

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Claim Mileage And Business Car Expenses On Taxes

Reporting Mileiq Mileage With Tax Software Mileiq

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Self Employed Mileage Deduction Rules Your Guide To Deducting Mileage

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos